#site_titleHomeowners vs. dwelling fire insurance—what’s the difference? Learn which policy you need for rentals, vacation homes, or vacant properties.

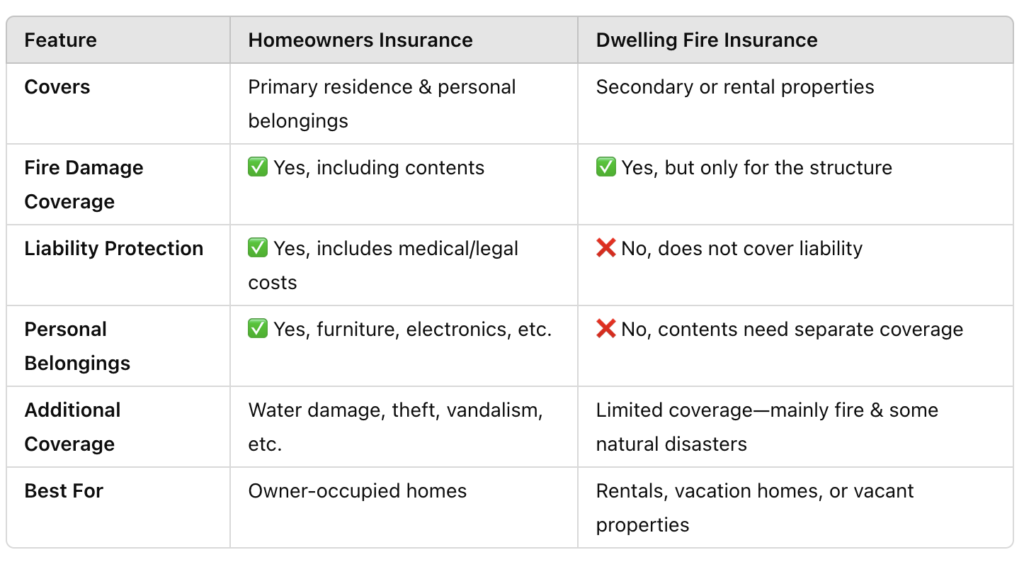

At first glance, homeowners insurance and dwelling fire insurance might seem similar—but they serve very different purposes. One protects your primary home and everything inside it, while the other covers properties you don’t live in full-time.

Do you own multiple properties or a vacation home? Do you know if homeowners insurance is enough to protect them?

What if your rental property burns down—would your insurance cover the loss?

In this guide, we’ll break down the key differences between homeowners insurance and dwelling fire insurance, so you can ensure your properties are properly protected.

We’ll compare coverage, explain when each policy applies, and help you determine which one is right for you.

Homeowner’s Insurance

Homeowner’s insurance is intended to safeguard your house and possessions in the event of calamities that harm your home. This policy covers fire damage to the structure of your main abode and its contents. Your primary residence is usually where you spend most of the year, which typically contains a majority of your belongings, giving your homeowner’s policy coverage for both the house and most belongings.

Dwelling Fire Insurance

If you own multiple properties or have more than one residence on your land, your homeowner’s insurance may not be adequate in the event of a fire. Dwelling fire insurance provides coverage for houses you own but doesn’t occupy most of the time. This could include vacation homes, cabins, cottages, or rental properties.

Dwelling fire insurance is a type of policy that covers houses other than your main residence. Just like homeowner’s insurance, it will pay for the expenses associated with restoring or rebuilding after a fire. It also safeguards any structures connected to the house, such as decks, porches, and attached garages. On the other hand, dwelling insurance does not provide protection for liabilities or personal items inside the house.

When Do You Need Dwelling Fire Insurance?

📌 If You Have Credit or Claim History Issues

If poor credit or past insurance claims make it hard to get homeowners insurance, a dwelling fire policy can provide basic fire protection .

📌 If You Own Rental Properties

Rental homes face risks like tenant negligence or fire hazards —a dwelling fire policy ensures you’re covered.

📌 If You Own a Vacation or Secondary Home

Less frequent use = higher fire risk. A dwelling fire policy protects the structure even when you’re not there.

📌 If Your Home is Vacant or Undergoing Repairs

Vacant homes are high-risk for fires, vandalism, and electrical issues.

Some policies also offer liability coverage if fire spreads to a neighbor’s property.

Investment Properties :

Fire dwelling insurance is frequently used to protect rental homes from the risks of fires, which are often caused by negligent actions. Even if you don’t live in the home, you can’t control what happens. In addition to covering the costs of rebuilding after a fire, this type of insurance pays for tenants to move as well as reimburses you for lost rental income.

Secondary Residences :

If you own a vacation home or cottage that you only visit periodically, it is important to have protection against fire damage. Fire dwelling coverage can cover secondary residences, and additional coverage can be added to protect the contents of the home.

Vacant Property:

A fire dwelling policy can be a great asset for a home that is up for sale or undergoing repairs. Unoccupied homes are particularly vulnerable to a variety of potential fire hazards such as electrical shorts, vandalism, and even lightning strikes. Without someone present to take notice of a potential problem, or take action to prevent it, the risk of a fire breaking out is much higher.

Fortunately, a fire dwelling policy can provide a degree of protection for a home in this situation. This type of policy will often provide coverage for necessary repairs or replacement of any damaged items. In addition, it may also offer liability coverage in the event that a fire causes damage to neighboring properties. By taking out a fire dwelling policy, homeowners can rest assured that their home is covered in the event of an unexpected fire.

✔ Now that you understand the key differences between homeowners insurance and dwelling fire insurance, you can make an informed decision about protecting your property.

✔ Choosing the wrong policy—or failing to have the right coverage—could leave you financially exposed in the event of a fire or other disaster.

✔ Your next step? Speak with an insurance expert to determine which policy best fits your property’s needs.

At Vargas & Vargas Insurance, we specialize in finding the right coverage for every property owner. Contact us today at 617-298-0655 or Contact us today to get expert guidance and a custom quote.