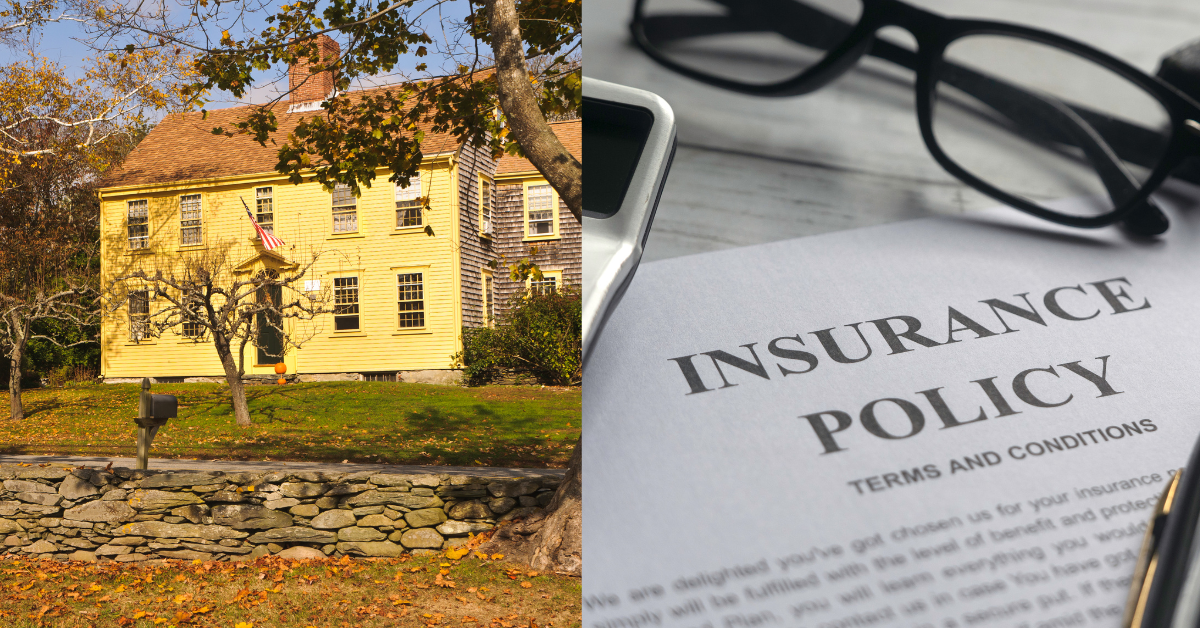

Understanding Massachusetts’ Enhanced Homestead Protection: $1 Million Home Shield

Good news for Massachusetts homeowners – the state has significantly expanded its Homestead Protection Act, offering increased security for your most valuable asset. For just $35, homeowners can now protect up to $1 million of their home’s equity from certain creditors. This enhanced protection represents a major upgrade to one of the most practical and affordable legal protections available to homeowners in the Bay State.

What is Homestead Protection?

Think of homestead protection as a legal shield for your home. It helps protect your home’s equity from certain creditors if you face financial difficulties, such as overwhelming medical bills, credit card debt, or other financial challenges. This protection becomes especially valuable during unexpected life events like job loss, illness, or economic downturns.

The Million-Dollar Upgrade

The Massachusetts Legislature has recognized the significant increase in home values over recent years. By raising the protection limit to $1 million, they’ve ensured that homeowners have meaningful protection that reflects today’s real estate market. This amount covers the equity in your primary residence – the difference between what your home is worth and what you owe on your mortgage.

What Protection Does It Offer?

The Homestead Act protects your home equity from:

– Credit card debt collectors

– Medical bill collectors

– Slip and fall claims

– Most civil judgments

– Many other types of unsecured debt

However, it’s important to understand that the protection doesn’t apply to:

– Mortgage payments

– Federal, state, or local tax liens

– Court-ordered support payments

– Prior recorded liens

How to File for Homestead Protection

Filing for homestead protection is surprisingly simple and affordable:

1. Obtain the Declaration of Homestead form from your county Registry of Deeds

2. Complete the form with your property information

3. Have the form notarized

4. File the form at your Registry of Deeds

5. Pay the $35 filing fee

Automatic vs. Declared Protection

Massachusetts actually provides two levels of homestead protection:

1. Automatic Protection: Every homeowner receives automatic protection of $125,000 without filing anything.

2. Declared Protection: By filing a Declaration of Homestead, you increase your protection to $1 million.

For more detailed information about homestead protection and filing requirements, visit the Massachusetts Registry of Deeds.

Why File Now?

The modest $35 filing fee makes homestead protection one of the most cost-effective forms of asset protection available. Consider this: for less than the cost of dinner out, you can protect up to $1 million of your home’s equity. Legal experts, including the Massachusetts Bar Association, consistently recommend filing for homestead protection as a fundamental step in personal financial planning.

Special Considerations

– If you’re over 62 or disabled, you may qualify for additional protections

– Both spouses in a married couple can file separately to potentially increase protection

– Protection applies only to your primary residence

– You must refile if you move to a new primary residence

The Bottom Line

In today’s uncertain economic climate, protecting your home’s equity is more important than ever. Massachusetts’ enhanced Homestead Protection Act offers significant peace of mind for a minimal cost. While it may not protect against every type of claim, it provides substantial security against many common financial challenges that could threaten your home equity.

Don’t leave your home’s equity unprotected! A Declaration of Homestead can shield up to $500,000 of your home’s value from most creditors – a crucial step in protecting your family’s financial future. Need help getting started? Visit vargasinsurance.com for our trusted attorney referrals who can guide you through this simple but vital legal protection.

#MassRealEstate #MAHomeowner #HomeProtection #MassLaw #FinancialPlanning #HomeEquity #MassHousing #BostonRealEstate #PropertyProtection #RealEstateTips #MortgageProtection #HomeownerRights #MassProperty #PersonalFinance #WealthProtection #MassLegal #HomeSecurity #BayStateHousing #EstatePlanning #MassNews