Everyone lives in a Flood Zone!

Hurricane season is upon us, and based on the devastation that Houston is going through (and with another hurricane on the way) this season may not turn out to be a walk in the park for homeowners and renters.

I am not sure if you are aware, but flood damage (and earthquake damage) are excluded under all homeowners, condominium, and renter’s insurance policies. If you are in a Federally Mandated Flood Hazard area, you are required to purchase flood insurance to satisfy your Mortgage Company or bank. But there is a misconception that if you are not in a Federally Mandated Flood Hazard area, you are not able to purchase flood insurance – that is incorrect.

Everyone who owns a home or condominium or rents an apartment is able to purchase flood insurance, and if you are NOT in a Federally Mandated Flood Hazard area, you could receive a “preferred rate.”

As an example, the flood insurance policy that Kathy and I carry on our home costs us $1389 per year for $50K on contents and $50K on the building because we are in a Federally Mandated Flood Hazard area. If we were NOT in a Federally Mandated Flood Hazard area our rate would be around $499.00 per year for up to $250K on the building and $100K on contents, a big difference.

Here is the second misconception to flood insurance: many people think that they will purchase a flood policy when they need it or a hurricane is heading in their direction. It does not work this way, as there is a 30-day waiting period on all new flood insurance policies (unless you are purchasing the coverage for a closing or refinance).

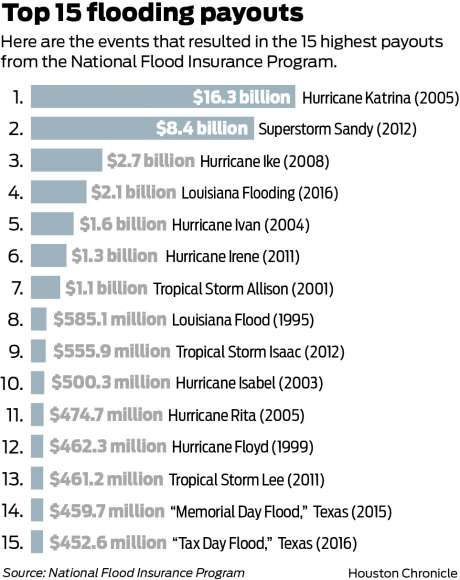

Here are some statistics for homeowners:

1. In the past several years, 60% of all declared disasters involved flooding

2. 25% of all insurance claims paid by FEMA involved losses outside Federally Mandated Flood Hazard areas.

3. 51% of all homeowner insurance claims are related to weather or flooding

And it gets worse for business owners. Here are 3 statistics that every business owner should know:

1. Almost 40% of small businesses never reopen their doors after a flood disaster.

2. Floods happen everywhere. 25% of all flood damage occurs in low to moderate flood risk areas. Business owners should not rely on a line of credit at their bank for protection.

3. Business insurance policies exclude flood damage. Only flood insurance pays qualified claims quickly so a business owner can get back to business

I strongly urge you to call Vargas & Vargas Insurance (your Lolocal independent insurance agent) and request a FREE flood insurance quote. Or click here.

If you are inclined to make a donation to help the wonderful people of Houston Texas, my mortgage friend, Richard Smith, recommends making a donation on this site, click here.

Thank you!

Carlos