Best Apps for Setting a Budget | Blog | Vargas & Vargas Insurance

Everyone needs a good budget. You should be able to quickly determine how much you’re earning, how much you’re spending, and how much you’re saving. In the olden days, this was done with pen and paper. Then technology emerged and spreadsheet software became the best way for setting a budget. Nowadays, great budgeting tools are only a few taps away. Check out some of the following apps that will help you set (and stick to) a budget. All are available on both Android and iOS . Most are even free!

This app syncs with your bank and credit cards, and then shows an easy-to-read infographic of how much money you may spend for the day, week, and month. Overall, it is a very simple and easy to use app, with very little customization needed.

One of the best apps with a website counterparts, You Need a Budget allows users to input their income and expenses so that their available budget is available on the go. This app also allows you to see exactly how much of your budget is available in several different categories, including groceries, restaurants, business expenses, and more.

If you’re looking for an app that can help with your budget and also help you keep records of your bills and receipts, look no further than Spendee. For less than $2, this app allows you to see all of your expenses in their attractive interface, and also keep track of your bills and receipts by taking pictures of them and storing them within the app.

Have you ever heard of envelope budgeting ? It’s a simple budgeting technique where you take out a certain amount of cash from each paycheck, and split that cash into several envelopes labeled with categories. The challenge is to use the envelope’s cash until you get paid again. Setting a specific budget per category is often helpful for people looking to budget, and it’s exactly what this app does!

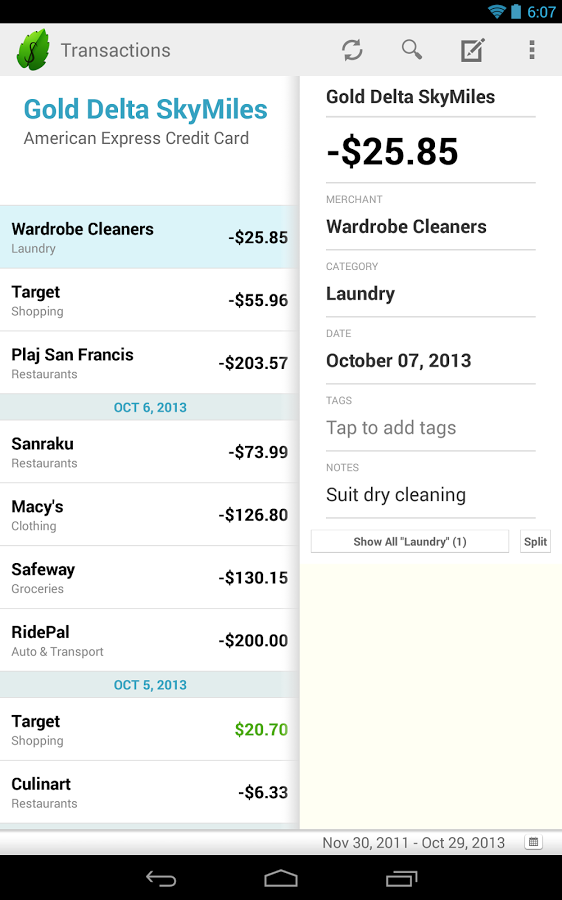

Arguably one of the most powerful budgeting tools currently available, Mint.com is a web tool with an great app counterpart. If you’re looking for a one stop shop for all of your budgeting needs, you may want to check out Mint – just be aware that to access all of its tools, you will need to give it access to your online banking accounts. But don’t fear, the information is kept safe. Once your account is set up, you will be able to budget and then keep track of all of your finances (including debit accounts, credit accounts, outstanding loans, and more) in one place!

Will you be using any of these budgeting apps to help in setting a budget this year? If you do try one of these apps, let us know what you think of it! And remember that Vargas and Vargas Insurance Agency could help you lower your ‘Insurance’ budget with one quick call to 617-298-0655 ! Speak to one of our friendly and knowledgeable agents about how to lower your Dorchester home insurance , or your Boston auto insurance.